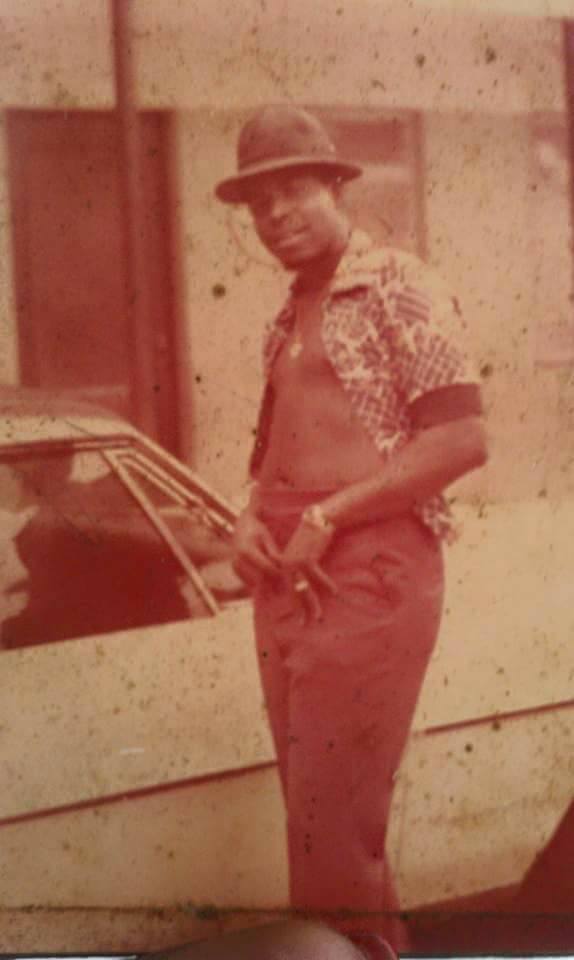

A few days before Father’s Day – June 17, 2010 – my Dad died of complications from diabetes. A few days before his death I was trying to find a rehabilitation center to care for him even though he did not have long-term care coverage. To me, my father was larger than life. There was nothing he would not do to help his family. I tried to use every resource available to me to help him. It is still painful to remember my father lying in a hospital bed, unable to move without help. The maxim, “Once a man twice a child” is one of those realities we will face when it comes to the care and well-being of our parents. My father’s illness and death taught me that valuable lesson and it guides and motivates me as a life insurance specialist.

After dad’s death, we learned that he did not have adequate life insurance coverage. His funeral tab was $12,500. After 36 years my mother not only lost her husband but had to face the hard truth that she could not afford to lay him to rest. I was depressed, in mourning, and frustrated because I had no ideas about covering the cost of his farewell. I had no time to properly grieve for my father during all those things. I could not stop and cry nor mourn. The night he died; I made the drive home hoping I could find the strength to write his obituary. I became overwhelmed by my emotions; yet I forced myself to stop crying and figure out how I was going to pay for his funeral.

My solution? Take money from my retirement account. My father was the king of our castle and I wanted nothing more than to send him off as such. Sadly, the funeral we settled for was not the way we wanted to bury him; but we got it done. No one should ever have to go through what my family and I went through. The feeling of desperation could have been avoided if we had planned for that day and had a proper and well-thought out amount of life insurance.

After June 2010, I promised myself that no one I meet would be uninformed or ill-informed about life insurance. No other family would cross my path without me engaging with them about the certainty of death and the honor in being able to play final life services without begging, borrowing or moving money from established account for something else. Let’s have the conversation!

If you need life insurance, or just need advice on how to plan for the loss of a loved one please feel free to contact me www.brooksstar.com. You can also follow me on Facebook & Instagram @brooksstarservices